How Israeli companies are riding the Covid wave to Wall Street

It’s not in spite of Covid that Israel has been able to succeed; it’s because of this challenging time that many companies reached this benchmark.

It’s not in spite of Covid that Israel has been able to succeed; it’s because of this challenging time that many companies reached this benchmark.

SPACs took off during the pandemic and created a major buzz in the Israeli ecosystem and on Wall Street as popular alternatives to IPOs.

Through October, 14 companies had conducted IPOs worth $650 million in Tel Aviv this year, with eight of those tech or innovation-focused startups.

Figure represents the highest H1 exit value in the last five years in Israel, according to IVC–Meitar Exit Report.

PwC report shows 9% increase in M&A deals and in deals worth $400m or more; IPOs on Israeli, US, European and Australian markets also rose.

End-of-year reports show 52 Israeli companies were acquired for some $15 billion, nearly double 2013’s exits worth $7.6 billion.

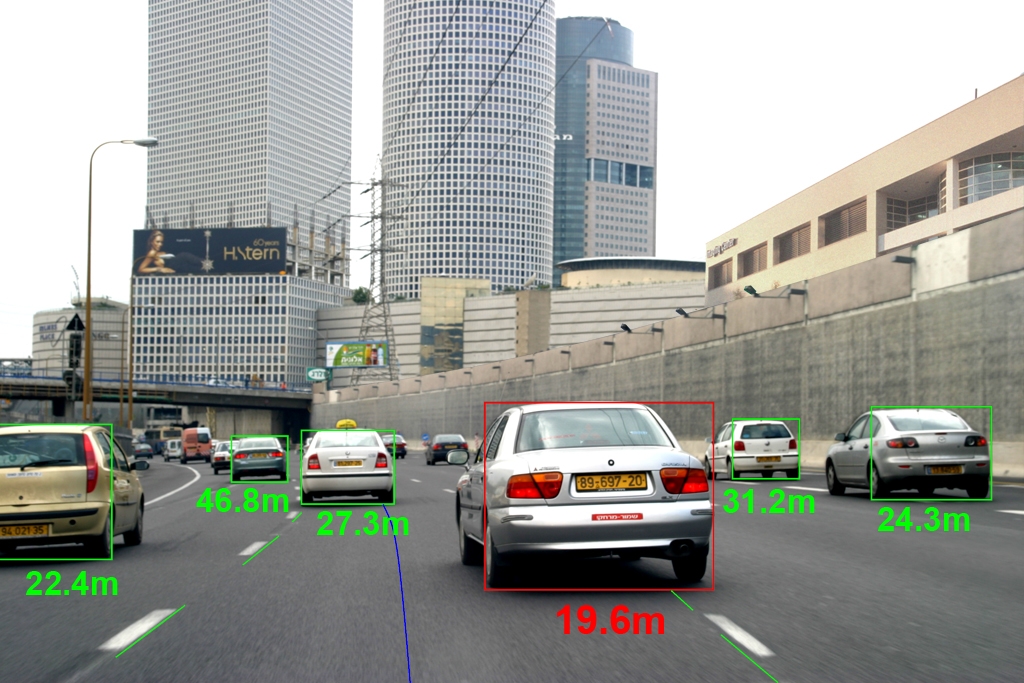

Israel’s collision-avoidance technology is integrated into more than three million vehicles including by the likes of BMW, General Motors, Volvo, and Ford.

Calcalist financial news site says Israeli maker of collision-avoidance technology to raise $500 million on initial public offering.

Israeli cloud-based web development platform starts trade on the NASDAQ.

Tel Aviv-based startup has helped 38 million people and businesses build websites.

The developer of chip and camera-based technology that helps drivers avoid a collision is the highest privately held tech company in Israel.

Israeli language-translation software company eyes BBYL ticker symbol.