Why Israel is disrupting the US insurance industry

The world’s largest insurance market is turning to small Israeli startups to disrupt and enable their operations.

The world’s largest insurance market is turning to small Israeli startups to disrupt and enable their operations.

Despite the coronavirus pandemic, some Israeli companies are still raising money and going public.

Riskified, Sisense, VAST Data, Via, Compass, Lemonade, Payoneer, Taboola and The We Company each has a $1 billion or more valuation.

Razor Labs, Zebra Medical Vision, Healthy.io, Lemonade, Viz.ai and Snyk were chosen for bringing outstanding AI capabilities to the market.

Israeli financial technology startups help power the New York financial center’s shift to fintech ecosystem leader.

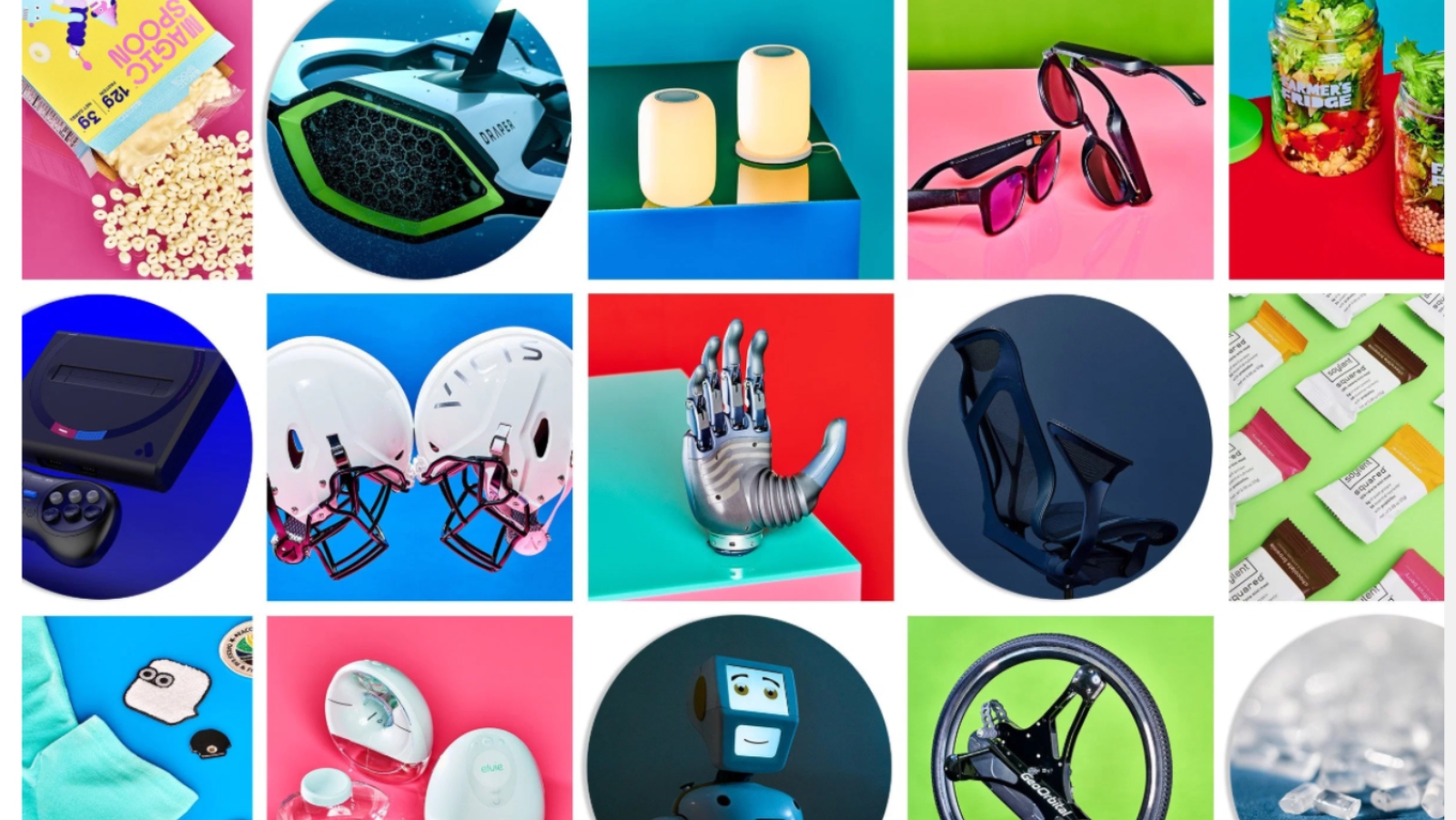

Watergen, Tyto Care, OrCam, ECOncrete, Theranica, Temi and Eviation products make main list; Lemonade and ElliQ receive special mention.

IVC reports that $2.32 billion was raised in 125 deals in an unusually prolific second quarter of 2019.

‘This sector’s vital signs are positive,’ reports IVC Research in its summary of Israeli artificial intelligence startups.

Europe’s 100 Hottest Startups 2018 includes a list of 10 in Tel Aviv that stand out in the eyes of this influential Condé Nast publication.

Arriving in America flush with ambition rather than cash, these Sabras climbed quickly up the ladder of success.

In the month of December alone, three companies raised more than $100m: Sirin Labs, Insightec and Lemonade.

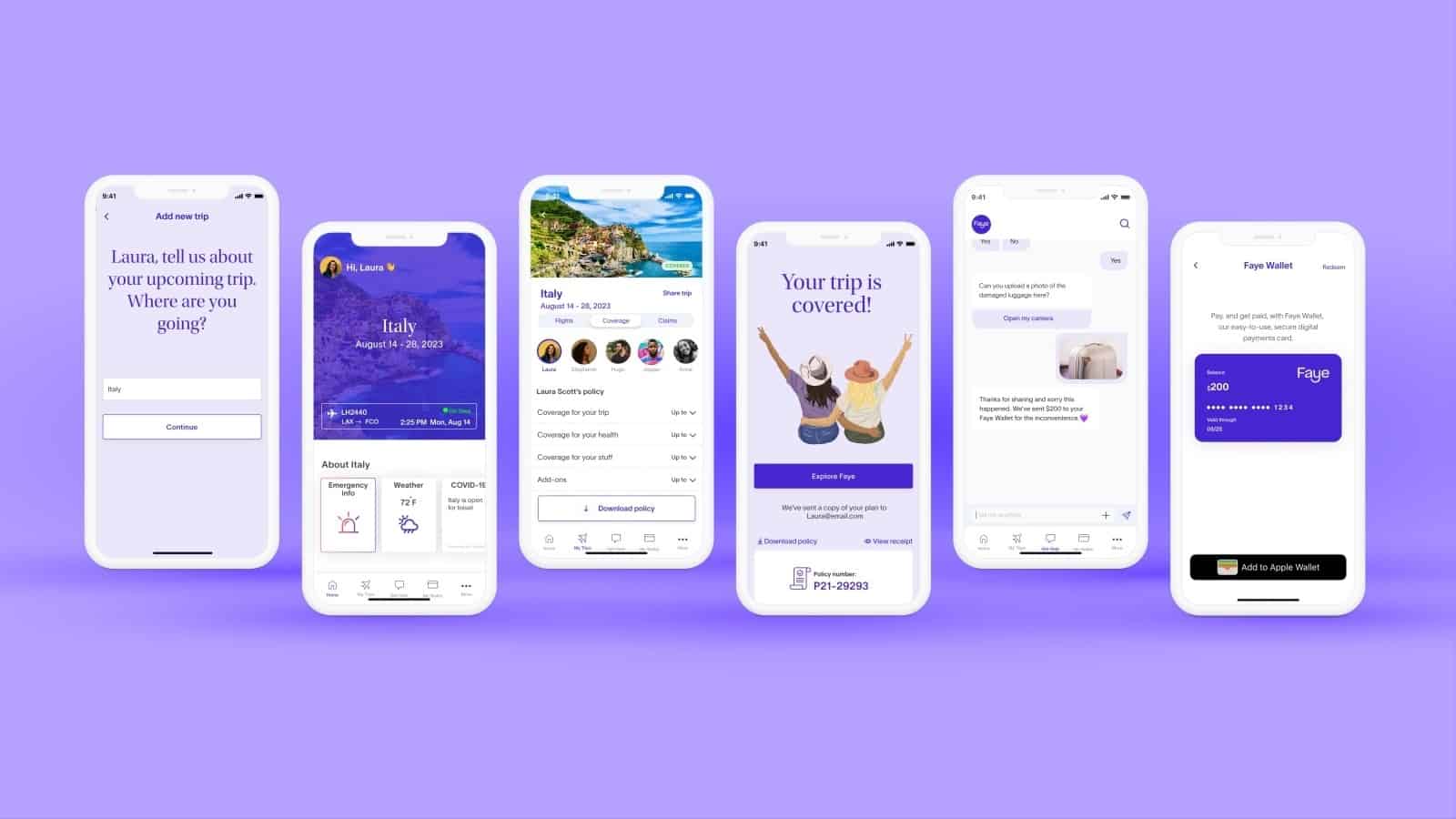

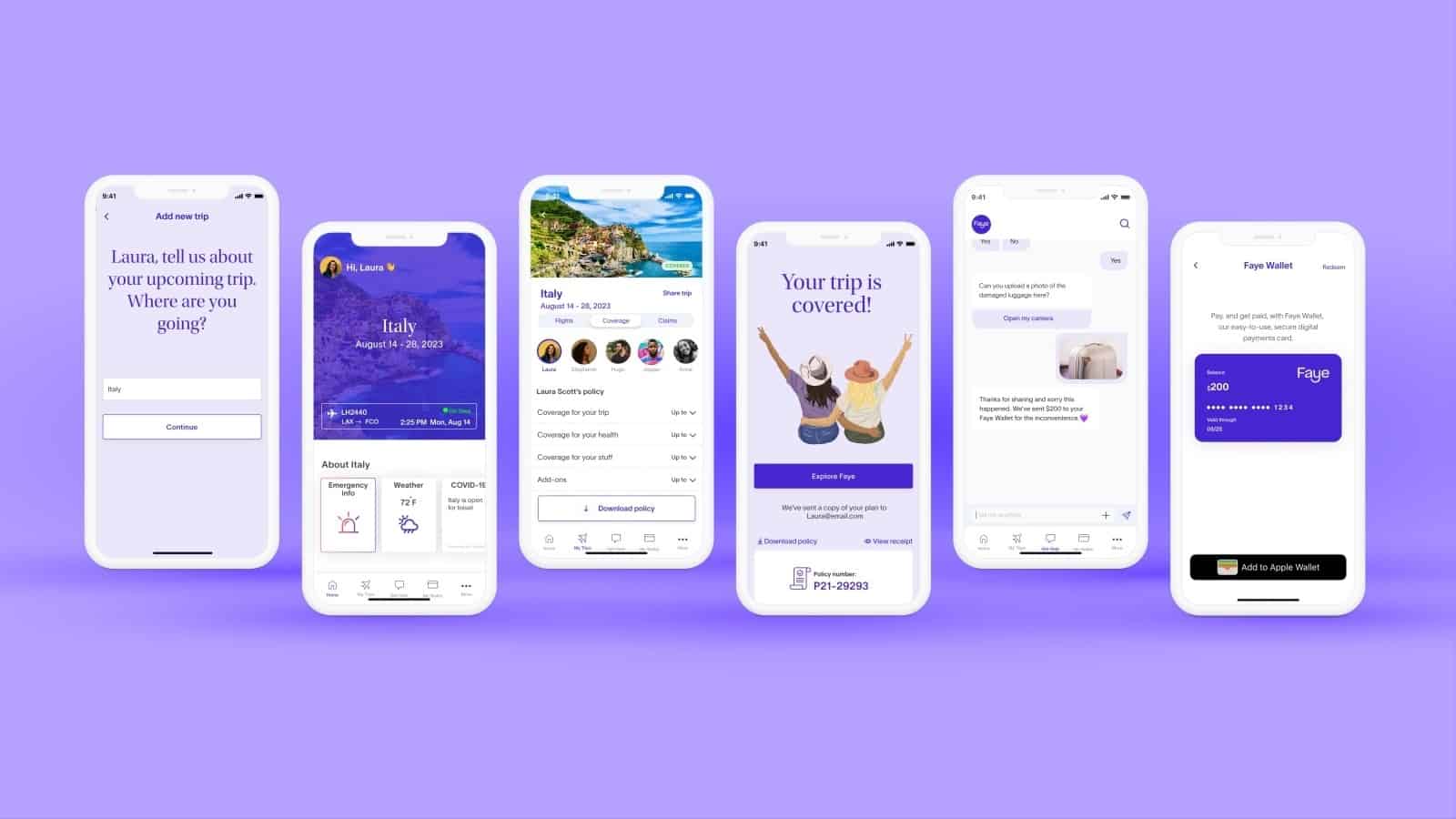

A look at the Israeli brains behind the hot insurance app claiming 14,000 subscribers in New York, California and Illinois.

There are more than 430 Israeli companies developing products for moving and protecting money in the digital age. ISRAEL21c takes a look at 18 making headlines.